Intuit is not a Mac friendly company. They make an OS X version of Quicken, but it is artificially crippled in order to try to get banks to pay them money. Intuit will only let you import files from banks that pay extra to let their customers download transactions into Quicken for Mac. The fact that you paid for Quicken and the bank paid for a Quicken server isn’t enough. They want the banks to pay another fee for their Mac users–even though there is no additional hardware or software involved. The end result is that Mac users get a product that will only work with a handful of banks. This article discusses a method to get around this limitation.

- Quicken 2005 Mac Download Full

- Quicken 2005 For Mac Download

- Quicken 2005 Mac Download Free

- Quicken 2005 Free Download

- Mac Download Game

When I used a PC I was a heavy Microsoft Money user. When I switched to a Mac, I assumed that after all the good things I had heard about Quicken that I’d be better off. This did not turn out to be the case. I bought a copy of Quicken, installed it, headed over to my bank’s website and downloaded the QFX file using the WebConnect button and told Quicken to import it. I was greeted with the following error box.

Quicken 2005 for Mac lets you see you save, invest, and track profits in minutes. Track your checkbook and spending, manage your investments, prepare for tax time, and much more! Quicken 2005 for Mac helps keep your finances and investments on track. Features: Easily download your banking, credit card, and brokerage transactions right into. Dec 27, 2010 The original version of Quicken (Quicken 2005) is no longer available to download onto my laptop. If there's nothing else I can do, let me know and I'lll accept your answer. Tech Support Rep: Robert M., Consultant replied 10 years ago. Intuit quicken deluxe 2004 free download. Business software downloads - Quicken by Intuit Inc. And many more programs are available for instant and free download.

Me: Why can’t I import a QFX file into Quicken Mac.

Quicken: Because your bank doesn’t support Mac QFX files.

Me: But they are both text files based on the OFX standard.

Quicken: But banks decide which formats they want to support.

Me: Are you telling me that there is a difference between an QFX file for a Mac and one for a PC.

Quicken: Yes they are different.

Me: Why would people use OFX if it was limited to only one platform?

Quicken: I don’t know.

Me: Ok on a bank that supports the “Mac format” there is only one link to download. How can it be a different file?

Quicken: I don’t know, but banks have to support the Mac format for Mac users.

Me: I’m looking at a QFX file right now from a bank that supports Macs and one that doesn’t. The file format is identical.

Quicken: No they are different.

It was at this point that I realized I was not going to get anywhere with tech support. Innova 3140 software update. So I started trying to figure out what was causing the problem myself.

I don’t know what it is like to use their PC product, but from an OS X standpoint Quicken is Evil. It isn’t that their product is bad, it is that they follow absurd business practices that will make your life miserable if you are using something other than Windows. If you go to the Quicken site and look at their list of supported banks, it looks very good and reassuring. Most major banks are listed, so it should be no problem to download and import transactions. The problem is in the fine print. Very few of the banks support “Quicken for Mac”. This seems odd because the OFX, QFX and QIF file formats are completely independent of the operating system. In fact that is the whole point of OFX–to have a platform independent way of representing financial data. It should work on PalmOS, OS X, Windows, Linux, HPUX, anything.

In older versions of Quicken and other money management software, you’d simply download a .QIF file and import it. QFX can work the same way, but it contains additional information about your account and bank. Most banks have upgraded to using QFX (WebConnect) because it helps prevent repeat transactions so you don’t have to be as careful about selecting the exact dates for import.

It turns out that when you try to import a QFX file, Quicken looks at the ID of the banking institution in the file and then goes to the Intuit web site and asks if it should allow you to import the file. Intuit’s site sees that the request is coming from a Mac and then checks to see if the bank with that ID is listed as supporting the Macs. If they don’t Intuit sends back a message telling Quicken to not allow the file to be imported. Banks have to pay Intuit extra money to say that they support Mac. Since the number of Mac users is smaller than PC users, many banks don’t pay the extra fee. In my opinion this amounts to artificially crippling their product for Mac users. Huawei e303 modem unlocker 2013 v1.000 free download. The files are identical for any type of computer.

There is a way around this stupid limitation. You simply tell the QFX file to use a different Bank ID number. If you choose a bank that supports “mac format”, Intuit will let you import the file.

First download the QFX (webconnect) file from your bank and then open it in a text editor. You should see a section that looks something that looks like:

INTU.BID stands for the Intuit Bank ID. and INTU.USERID is the bank’s user id. These two numbers function as the username and password to allow or disallow Mac users from importing files. Intuit allows Washington Mutual (shown above) to let their customers use Quicken on a Mac, so by replacing your INTU.BID and INTU.USERID sections with what is shown above you can import the file.

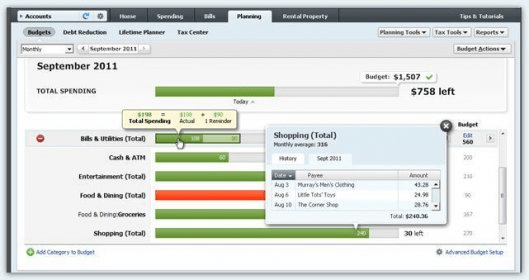

It can be a little tricky to get the file imported because you’ll need to make sure Quicken associates it with the correct account. You may need to change the name of the bank on your account before you import the file. The easiest way is to create a new account when you import the file as shown in the image. You can then go in and edit the name of the account, but you’ll need to leave the name of the bank set to Washington Mutual.

Quicken 2005 Mac Download Full

Another possible way to work around the limitation is to redirect all traffic to Intuit to your local machine and return the proper codes to authorize the transaction regardless of which bank a QFX file comes from. Ideally someone could setup their own server to act like Intuit’s server and return affirmitive responses to all requests.

Update: more information in a new article

Microsoft Word is the undisputed king of text-editing apps on the Mac, and similarly, Quicken is virtually without competition when it comes to personal-finance software. Just as Microsoft has resorted to adding extraneous functions to entice users to upgrade periodically, Intuit has also succumbed to releasing new versions that sometimes contribute more to feature bloat than to significantly enhancing users’ productivity. Intuit claims that Quicken for Mac 2006 contains more than 50 improvements based upon user suggestions, but there are only four major new features—Smart Payee, .Mac backup, greater scheduling flexibility, and simplified downloading of multiple accounts. Meanwhile, many long-time annoyances remain.

Four helpful features

Smart Payee, the flagship new feature, offers the ability to batch-rename payees. For example, if a store name in a downloaded transaction appears in all capital letters followed by a cryptic merchant code, such as “WILLIAMSSONOMA01002369,” you can manually change it to “Williams-Sonoma.” Quicken then applies that change to all past and future transactions from the same payee. Everyone benefits—not just the anal-retentive crowd—because this reduces the total number of payees, resulting in more-accurate reports. Unfortunately, creating Smart Payees works differently when downloading transactions from a financial institution (just retype the name of the payee) than it does when browsing a register (click the arrow icon at the right of the payee field and select from the pop-up menu). And I defy anyone to figure out how to tweak the renaming rules without consulting Quicken’s 445-page PDF documentation.

In the wake of Hurricane Katrina, I really appreciate the added ability to automatically back up an encrypted version of my Quicken data file to my iDisk’s Documents folder whenever I close the file (you must subscribe separately to .Mac, of course). Keeping a current offsite backup couldn’t be easier. In this same vein, Intuit’s data recovery service is now free, no longer $200. The upgrade will pay for itself if you ever need to restore or recover a data file, but employing good backup practices with Mac OS X’s existing tools can accomplish the same thing without having to spring for the new version.

Quicken 2006 also features more choices in scheduled transaction frequencies to address common occurrences such as quarterly estimated taxes, biannual property taxes, and Social Security payments that arrive on specific days of each month. If you make heavy use of scheduled transactions, you’ll appreciate how Intuit has revamped this formerly confusing interface to reduce confusion.

The last major new feature is the ability to download data for multiple accounts from a single financial institution, such as separate personal and business checking accounts, or two spouses’ credit card transactions. Downloading all your data in one fell swoop is a definite time-saver, but hardly something to get excited about unless you have lots of accounts.

Most of the other improvements are so minor you probably won’t even notice them, and Intuit didn’t bother enumerating them. For example, a colored line in account registers delineates past and future transactions; the check number field now can display as many as eight digits; there’s support for the Check 21 ANSI format; and you can customize or rename transaction types as needed.

Still far from perfect

Despite these small improvements, many long-time quirks remain unaddressed, many of which Intuit says are not problems, but are by design. For example, you can’t allocate transactions to hidden accounts without first showing them; balances aren’t displayed when transferring funds between accounts; the Portfolio window lacks annualized rate of return; you must enter splits for every account in which you hold a company’s shares; entering investment actions is tedious because the default account isn’t the last one used; and you still can’t resize many of the dialogs to take advantage of large screens. One exception is my complaint that stock-price graphs don’t accurately reflect splits, which Intuit confirms, saying it is “actively looking at this,” though it has not promised a fix yet.

Macworld’s buying advice

Quicken 2005 For Mac Download

If you’re still keeping track of your finances with paper registers or Microsoft Excel, Quicken 2006 is a vast improvement and well worth the retail price. You can’t beat its integration with over 1,800 banks, brokerages, and credit card providers. However, if you’re already using last year’s release, only you can tell if the few new features are compelling enough to justify the $60 investment.

Quicken 2005 Mac Download Free

[ Owen W. Linzmayer is a San Francisco-based freelance writer who has recently written two Apple Training Series books: Desktop and Portable Systems, 2nd Edition (Peachpit Press, 2005) and Mac OS X Support Essentials, 2nd Edition (Peachpit Press, 2005).]